Many people dream of financial freedom – a life where you aren’t worried about bills because money flows in even when you’re not actively working. One way to get there is by turning a side hustle into passive income. In fact, around one-third (36%) of U.S. adults have a side hustle in 2024, often started to boost income as the cost of living rises. The exciting part is that some of these side hustles can grow into reliable passive income streams.

This article will break down recent trends in passive income, and share real-world examples of people who went from side hustle to financial freedom.

What Are Financial Freedom and Passive Income?

Financial freedom means having enough income (especially from investments or passive sources) to cover your living expenses without needing to work full-time. In other words, you’re free to decide how to spend your time because money isn’t an everyday worry. Passive income is the money you earn with minimal daily effort or supervision. Unlike an hourly job, passive income streams typically require upfront work (or investment) and then generate earnings on their own over time.

In the sections below, we’ll look at popular side-hustle paths that have the potential to generate passive income.

Why Side Hustles Are Booming (And How They Lead to Freedom)

Side hustles have become vastly popular in recent years, especially in the U.S. There are a few reasons for this trend:

Economic Pressures: With high costs of living and economic uncertainty, people want extra income streams. A side hustle can provide a safety net or help pay the bills.

Technology and Opportunities: It’s easier than ever to start a side gig. The internet and digital platforms let you reach customers worldwide from your living room. You can sell products on Etsy, tutor via Zoom, or monetize a YouTube channel with little initial money.

The Passive Income Appeal: People are drawn to the idea of making money while they sleep. Instead of trading more hours for dollars, a smart side hustle can be scaled or automated. Essentially, a side hustle can be a stepping stone to financial independence if it turns into a steady passive income source.

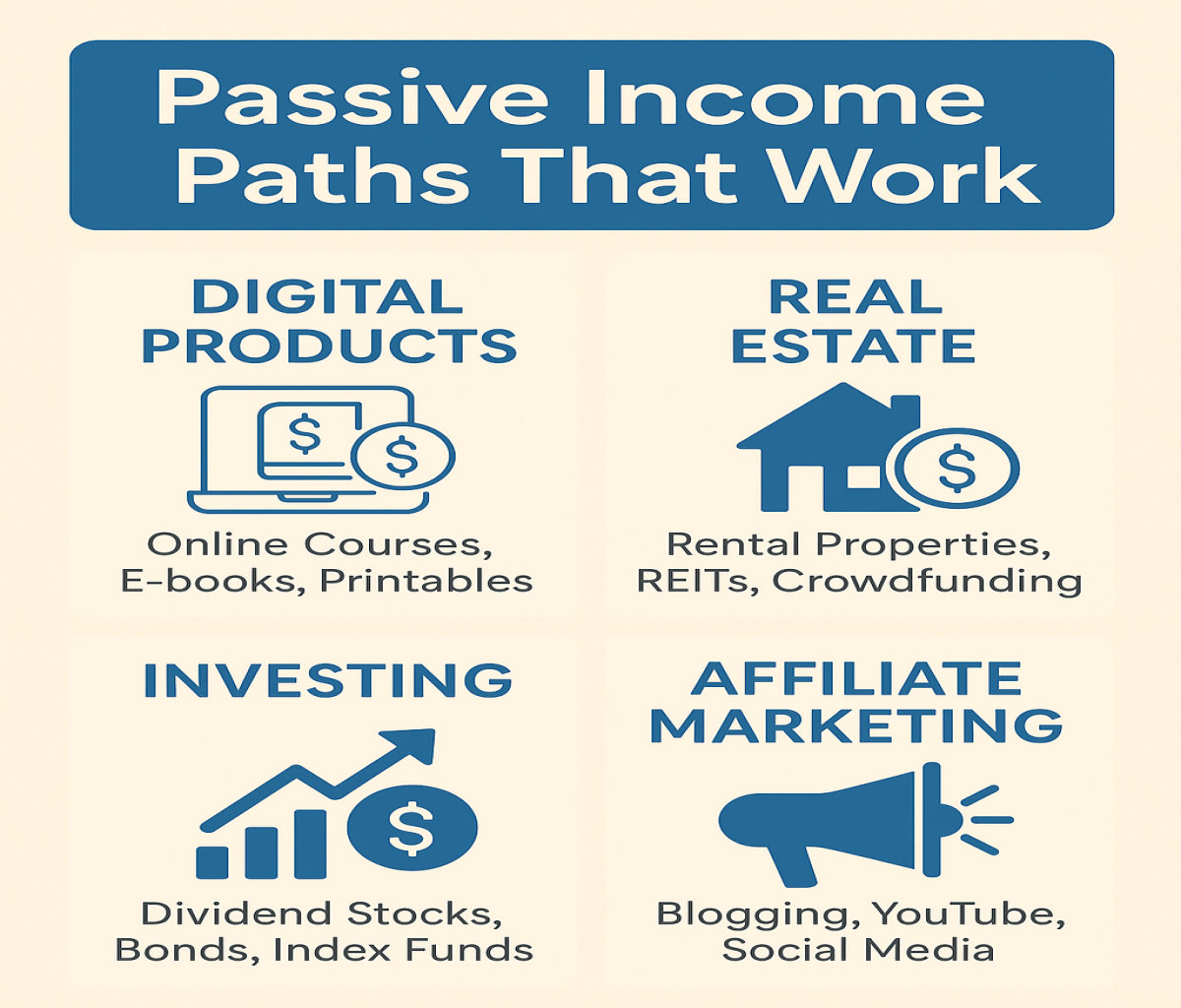

Passive Income Paths That Work

There are countless passive income ideas out there that can help you turn a side hustle to financial freedom. Here, we focus on four proven paths: For each path, we’ll explain how it works and why it’s a promising route toward financial freedom.

1. Digital Products (Online Courses, E-books, and More)

Thanks to sites like Etsy, Gumroad, Amazon Kindle Direct Publishing, and Teachable, the trend in digital product sales has grown. Digital items’ cheap overhead makes them beautiful; you don’t have to handle actual inventory or delivery.

What counts as a digital product? Here are a few examples:

- E-books & Guides.

- Online Courses or Tutorials.

- Printables & Templates.

- Stock Photos or Music.

The key with digital products is to identify a niche or problem and create something that provides value.

Trending now: Selling printables on Etsy is a hot trend in 2025. Many side hustlers have turned simple designs or planners into steady income. Digital courses have also surged, especially after COVID-19, as more people prefer online learning.

2. Real Estate (Rental Income Without a 9-to-5)

Investing in real estate is a more traditional path to passive income, but it’s still one of the most reliable. The idea is simple: own property that generates rent. If done right, the rent can exceed the costs (mortgage, taxes, maintenance), giving you extra cash each month without active labor.

You can use real estate as a side hustle to make passive cash in a few different ways:

- Rental Properties.

- Real Estate Investment Trusts (REITs).

- Crowdfunding Platforms.

Keep in mind: While rental income is often called “passive,” being a landlord does involve work – finding tenants, fixing leaks, etc. Many investors eventually hire property managers or outsource tasks to make it more hands-off. Some individuals even reach financial independence by accumulating a few rental properties that cover all their living expenses.

3. Investing in Stocks and Bonds (Let Your Money Work)

Another passive income avenue is investing in financial assets like stocks, bonds, or index funds. This isn’t a traditional side hustle in the sense of starting a business, but it’s a crucial passive income stream to discuss.

Here are common investing paths for passive income:

- Dividend Stocks.

- Index Funds or ETFs.

- Bonds and CDs.

Recent trends: With the rise of robo-advisors and investing apps, getting into the market is easier than ever for beginners. You can start with small amounts, and some apps like FIRE (Financial Independence, Retire Early) is a concept that mostly relies on stock investment as individuals save and invest aggressively to finally support their lifestyle.

4. Affiliate Marketing and Content Creation

A side project, affiliate marketing lets you get paid commissions by advertising goods or services of other businesses. Like blogging, YouTube, TikHub, Instagram, it usually goes hand in hand with content production. The concept is to provide material that appeals to a readership and then suggest items utilizing unique affiliate links. Imagine you write a blog post reviewing the best coffee makers, and you include Amazon affiliate links. A year from now, that post might still be getting Google search traffic and generating commissions

Some popular ways to do affiliate marketing as a side hustle:

- Choose a topic you like or know about.

- YouTube Channel or Podcast.

- Social Media Influencing.

Success Stories: Side Hustles That Became Passive Income Streams

Here are two real-world success stories of individuals who turned small side projects into significant passive income, moving closer to their financial freedom goals:

Rachel Jimenez, a 36-year-old mother of two from California, serves as an encouraging example. Rachel formerly worked full-time in higher education. She decided to start a side income selling digital things on Etsy, mainly printable templates and party games for consumers to download.

Fast forward to present, and Rachel’s once-small side venture has grown into a booming internet business. She currently earns around $10,000 per month in passive revenue from her digital items on medium.com. That’s right: five figures every month from stuff she largely makes in her living room! This amount of money enabled her to leave her 9-to-5 job and spend more time with her children. Rachel’s story shows that with consistency and smart product choices, a digital product side hustle can scale up.

Another notable example is Jasmine McCall, who transformed a content side hustle into a staggering passive income generator. In 2021, Jasmine was working at Amazon in a well-paying corporate position, but she wanted to earn a little additional money on the side, mostly to help cover childcare costs.

She launched a personal finance YouTube channel and gave ideas on how she improved her credit score. For the first six months, it was a small side project that earned roughly $1,000 per month. Then one of her videos became viral, which significantly increased her audience. By May 2022, Jasmine had earned enough money from her side hustle to quit her job and focus full-time on her own business.

Conclusion

Achieving financial freedom with passive income does not happen fast, but it is entirely doable with the appropriate attitude. The first step is to start a side hustle, which may be anything from building a best-selling digital product to renting out a house, investing in dividend stocks, or writing content that produces money while you sleep. Recent trends indicate that more individuals are exploring these options, and technology is making it easy for anybody to participate.

Pingback: 5 Effective Ways to Grow Your Side Hustle - Earn Ease Way

Pingback: Active Income vs. Passive Income: Understanding the Difference - Earn Ease Way

Pingback: Top Free AI Tools to Earn While You Sleep (2025) - Earn Ease Way